In the highly specialized field of financial risk management, two prominent designations stand out to professionals and aspiring students—Professional Risk Manager (PRM) and Financial Risk Manager (FRM). Behind these acronyms lies a wealth of knowledge, expertise, and recognition. But with so many factors to consider, how does one choose between the two?

If you’re among the growing number of finance professionals considering a career in risk management, you’ve likely come across the two most sought-after designations – PRM (Professional Risk Manager) from the Professional Risk Manager’s International Association (PRMIA) and FRM (Financial Risk Manager) offered by the Global Association of Risk Professionals (GARP). Both credentials are globally recognized and offer advanced quantitative training, making the decision challenging. It’s just like being caught between a rock and a hard place.

To transition from the detailed analysis of the PRM versus FRM certifications in the realm of risk management, we now shift our focus to a different yet impactful event, the recent Plymouth crash, illustrating the diverse spectrum of topics that hold significance in today’s discourse.

Comparing PRM and FRM: A Job Market Perspective

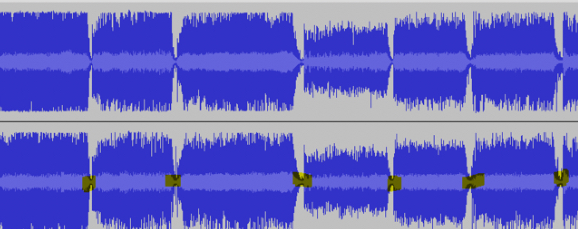

To gain a market perspective, one effective approach is to evaluate job postings requiring these certifications. Analyzing the job market can provide insight into the professional demand and recognition for PRM and FRM. While the FRM certification appeared to dominate the job market initially, a more in-depth exploration revealed that many job postings named PRM and FRM equivalently. This method, though not foolproof, offers a starting point when contemplating “PRM vs FRM.”

Detailed Analysis: PRM and FRM

Selecting an appropriate designation involves a complex decision-making process, particularly when assessing the value and market recognition of certifications such as Financial Risk Management (FRM) and Professional Risk Management (PRM). The initial methodology employed involved conducting a keyword search for “FRM” and “PRM” on a specialized financial employment platform, efinancialcareers.com. This empirical analysis yielded a markedly higher incidence of listings for FRM (22 instances) compared to PRM (3 instances), which tentatively indicated a preference towards the FRM designation.

However, this conclusion was subjected to further scrutiny. Subsequent investigations were carried out on additional financial job portals, where the findings demonstrated a more nuanced landscape. Although FRM continued to exhibit a relative advantage, it was observed that numerous job postings incorporated the “FRM” acronym in reference to specific business units within the organization, rather than explicitly denoting the FRM certification. Moreover, in instances where job descriptions expressly mentioned the FRM certification, there was also frequent acknowledgment of the PRM certification. This revelation underscored the complexity of the decision-making process, indicating that both certifications hold value and recognition in the industry, thereby necessitating a more comprehensive analysis before making a definitive choice.

The decision-making process regarding the selection between Professional Risk Management (PRM) and Financial Risk Management (FRM) certifications was influenced by several factors, delineated below:

Advantages of PRM:

- The PRM certification is posited to possess a more quantitative focus, aligning with the demand for analytical depth in risk management;

- It presents a more economical option, characterized by lower examination fees and the absence of annual membership dues;

- The PRM study materials offer a coherent self-study trajectory, comprising a singular comprehensive handbook as opposed to the FRM’s combination of a handbook and core readings, which may not directly correlate with exam content. This distinction suggests a potentially smoother and more efficient study process for PRM candidates;

- PRM offers greater examination flexibility, allowing candidates to attempt four exams in any sequence and on any business day, provided all are completed within a two-year timeframe. This contrasts with FRM’s biannual examination schedule at fixed locations;

- The PRM certification is endorsed by prestigious universities globally, indicating a broad academic and professional recognition.

Advantages of FRM:

- The FRM certification maintains a marginal lead in job market presence;

- It incorporates a mandatory work experience requirement, underscoring the importance of practical expertise in the field;

- Established in 1997, FRM boasts a longer history and greater recognition compared to PRM, which was established in 2002;

- A significant network of over 17,000 FRM graduates exists, providing a substantial community of professionals familiar with the FRM program, unlike the PRM, for which specific graduate numbers are unavailable;

- A Wall Street Journal article highlighted a significant surge in FRM candidates, reporting an 80% increase in 2009, which significantly influenced the perception of FRM’s growing relevance and preference within the industry.

The Transition from Non-Profit to For-Profit Status

Upon the verge of enrollment for the Financial Risk Management (FRM) examination, a pivotal revelation concerning the Global Association of Risk Professionals (GARP) was encountered through an exposé detailing the organization’s shift from a non-profit to a for-profit entity. Initially, GARP, the sole provider of FRM certification, operated as a non-profit organization. However, the subsequent decision to transition towards a profit-oriented business model marked a significant turning point. This strategic realignment resulted in disillusionment among certain GARP members, prompting them to establish the Professional Risk Managers’ International Association (PRMIA) alongside its PRM certification, maintaining a steadfast non-profit framework.

This scenario poses a critical examination of the ethical considerations inherent within the knowledge sector, particularly concerning the objective of profit maximization. The ethos surrounding educational and professional certification institutions traditionally aligns with a non-profit model, as evidenced by entities such as the CFA Institute and various academic institutions. The principle underlying this model is the prioritization of knowledge dissemination and professional development over financial gain, a stance that resonates with the broader expectations of ethical conduct within the sector.

The decision to select a certification path was significantly influenced by these ethical considerations. The perceived conflict of interest, akin to the dual roles of consulting and auditing services provided to identical clientele, raises questions regarding the integrity of profit-driven certification bodies. Additionally, the escalating costs associated with obtaining FRM certification—including increased examination fees, expensive study materials, and rising annual dues—underscore the financial implications of this profit-oriented approach. This knowledge, framing GARP as a profit-driven entity, informed the decision to disengage from pursuing FRM certification in favor of alternatives that adhere to non-profit principles, reflecting a preference for ethical alignment and transparency in professional certification endeavors.

The decision to pursue the Professional Risk Management (PRM) certification is based on several key factors:

- PRM is as rigorous as the Financial Risk Management (FRM) certification, according to industry experts;

- It has a stronger focus on quantitative skills;

- Endorsed by leading universities, enhancing its credibility;

- It is more cost-effective compared to FRM;

- Offers greater flexibility in exam scheduling;

- Grounded in ethical principles, aligning with professional integrity.

Although PRM currently has lower recognition outside the risk management field, efforts are underway to increase its visibility, including expansion into new regions like Asia. The belief in its ethical approach provides a sustainable advantage in the field of risk management.

Conclusion

When considering PRM versus FRM certifications, it’s crucial to recognize that neither is inherently superior. Your choice should reflect your career goals, learning style, and personal values. While FRM may have greater market recognition, PRM excels in quantitative training, affordability, flexibility, and ethical grounding. As the field of risk management evolves, both certifications will remain relevant. Thus, your decision should be based on assessing your future career aspirations, the investment needed, and the potential advantages each certification offers your professional path.